THE CHALLENGE

Our client, a fintech company specializing in personal budgeting and financial management, approached Ready Set with a challenge that was equal parts ambitious and delicate.

They needed to significantly reduce their cost per acquisition (CPA) and cost per install (CPI) while navigating the strict regulatory landscape of financial advertising.

The goal was to create and maintain a steady stream of engaging, native-feeling content for Meta and TikTok that would drive growth, all while avoiding regulatory red flags in their marketing claims or copy.

THE WORK

Ready Set developed a strategy focused on dynamic, trend-based ads to capture attention and drive performance. To meet the client’s needs, we prioritized engagement and brand awareness with a native, scrappy ad style that resonated with the platform’s audiences that also carefully adhered to compliance guidelines.

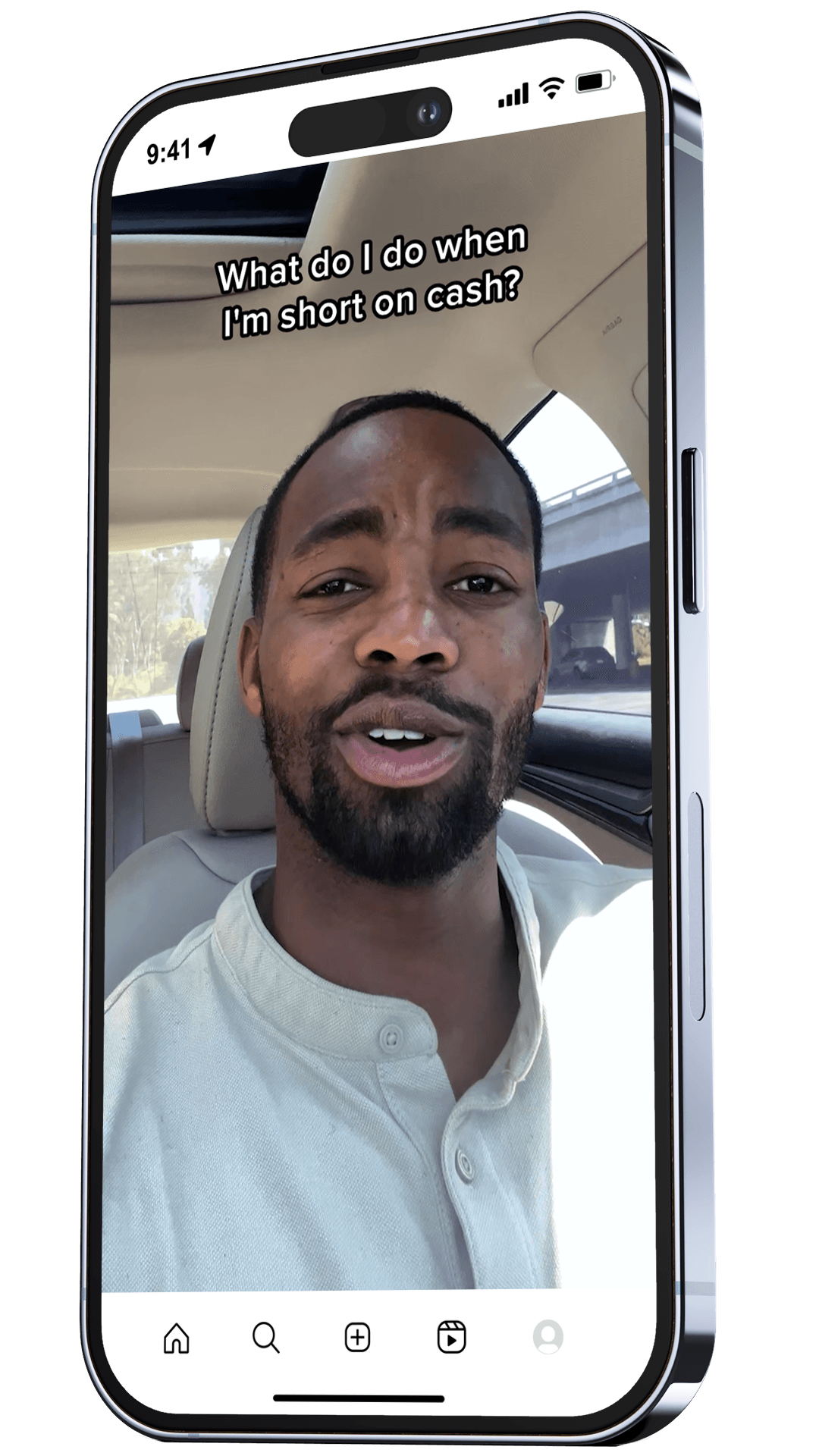

Our biggest win came with the “Reaction Tok” concept. We took the popular reaction video format and gave it a financial twist. Topics like cash flow management were part of a relatable, humorous narrative that resonated with the target audience. This innovative approach taught us a valuable lesson: in fintech advertising, authenticity and relatability are king. People don’t want to be *talked at* about money; they want to see their own experiences *reflected back at them*.

Energized by this success, we pushed further. We took to the streets with our “man-on-the-street” interview concept. These candid conversations about money problems didn’t just showcase the app’s solutions; they normalized discussions about financial struggles.

In a final bold move, we personified the app, creating skits that gave it a relatable personality. It was a risk – humanizing a financial service isn’t exactly conventional – but it paid off. Users weren’t just engaging with an app; they were connecting with a brand that understood them.

With each new idea came the challenge of compliance. We crafted a lexicon of approved terms and phrases, which pushed us to find innovative ways to convey messages within regulatory boundaries.

As the campaign evolved, we also kept our finger on each concept’s performance. We amplified what worked and refined what didn’t. This agility led us to tailor content for different platforms, crafting unique experiences for TikTok, Meta, and beyond. We weren’t repurposing content; we were crafting platform-specific experiences to boost engagement while navigating the unique compliance landscapes of each platform most effectively.

THE RESULTS

The impact of our innovative approach was reflected in the numbers. One of our top-performing ads achieved:

Ad spend also doubled in just 2 weeks, indicating strong efficiency to drive scale. Our platform-specific strategies paid off, with each channel showing improved performance.

Just as importantly, we achieved these results while maintaining strict compliance with financial advertising regulations. Our creative approaches don’t skirt the rules; they embrace them, turning potential restrictions into unique selling points.

Advertising that’s compliant, creative, and compelling

The most effective financial services advertising isn’t just about selling a product; it’s about starting a conversation. By bridging the gap between creativity and compliance, between financial services and genuine human connection, we created a blueprint for success in this challenging vertical.

In the world of FINANCIAL SERVICES ADVERTISING, we’ve shown that with innovation, creativity, and a deep understanding of both regulations and human nature, it’s possible to not only play by the rules but to CHANGE THE GAME ENTIRELY.